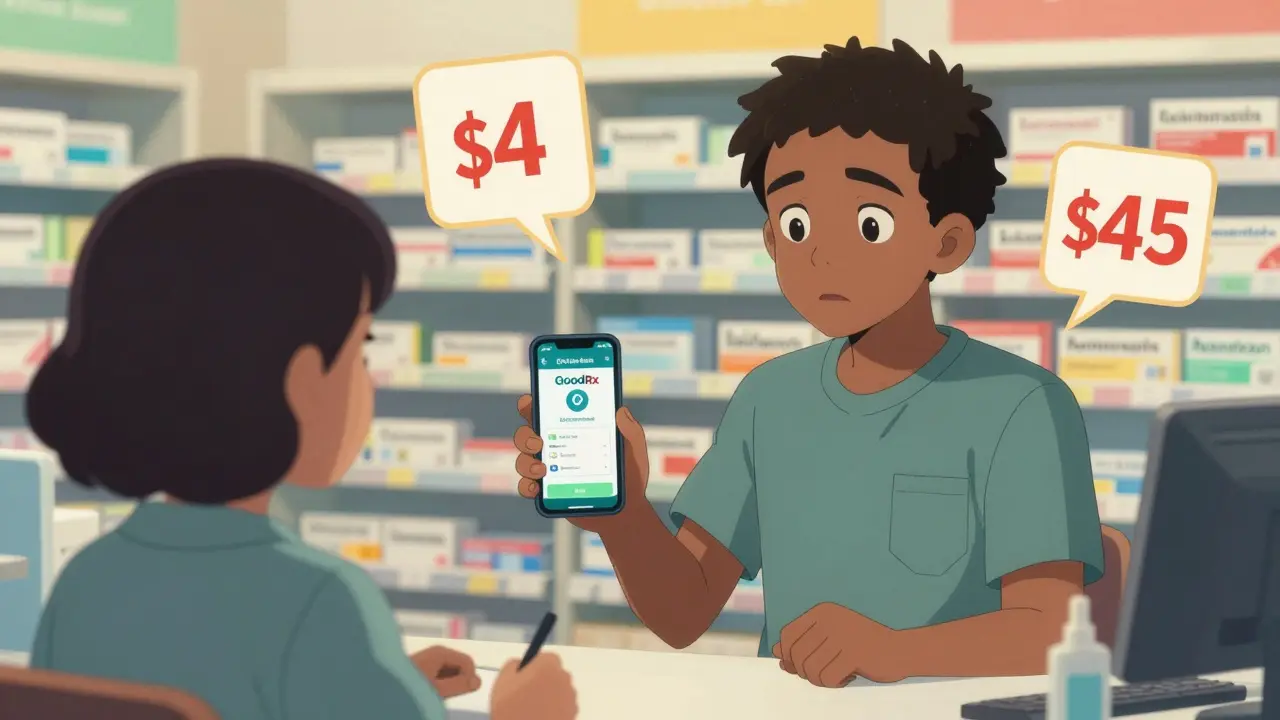

Buying generic drugs shouldn’t feel like a financial gamble. Yet for millions of Americans without comprehensive insurance-or those stuck with high-deductible plans-the cost of prescriptions can be shocking. A month’s supply of metformin might cost $4 at Walmart, but $45 at your local pharmacy. Lisinopril? $3 with a discount card, $50 without. These aren’t outliers. They’re the new normal. That’s where coupon and discount card programs come in. They’re not insurance. They’re not government aid. But for many, they’re the only thing standing between affordable meds and skipped doses.

How These Programs Actually Work

Discount cards like GoodRx, NeedyMeds, and Blink Health don’t negotiate with your insurance. They cut deals directly with pharmacies and drug manufacturers. Think of them as bulk buyers. The card providers promise pharmacies volume-thousands of prescriptions-and in return, the pharmacies agree to charge a lower cash price. When you show your card, the pharmacy pays a small fee to the card provider. You pay the discounted price. No claims. No paperwork. No waiting.

It’s simple. But that simplicity hides a big problem: prices vary wildly. The same 30-day supply of levothyroxine might cost $6 at CVS with GoodRx, $12 at Walgreens with Blink Health, and $3 at a local independent pharmacy with no card at all. That’s why you can’t just pick one card and call it done. You have to shop.

Who Benefits the Most?

If you’re uninsured, underinsured, or in the deductible phase of your health plan, these cards are a lifeline. A 2022 study in Circulation: Cardiovascular Quality and Outcomes found that patients using discount cards saved an average of 65% on generic medications for heart failure-like lisinopril, metoprolol, and spironolactone. For some, that meant dropping from $120 a month to $42. That’s life-changing.

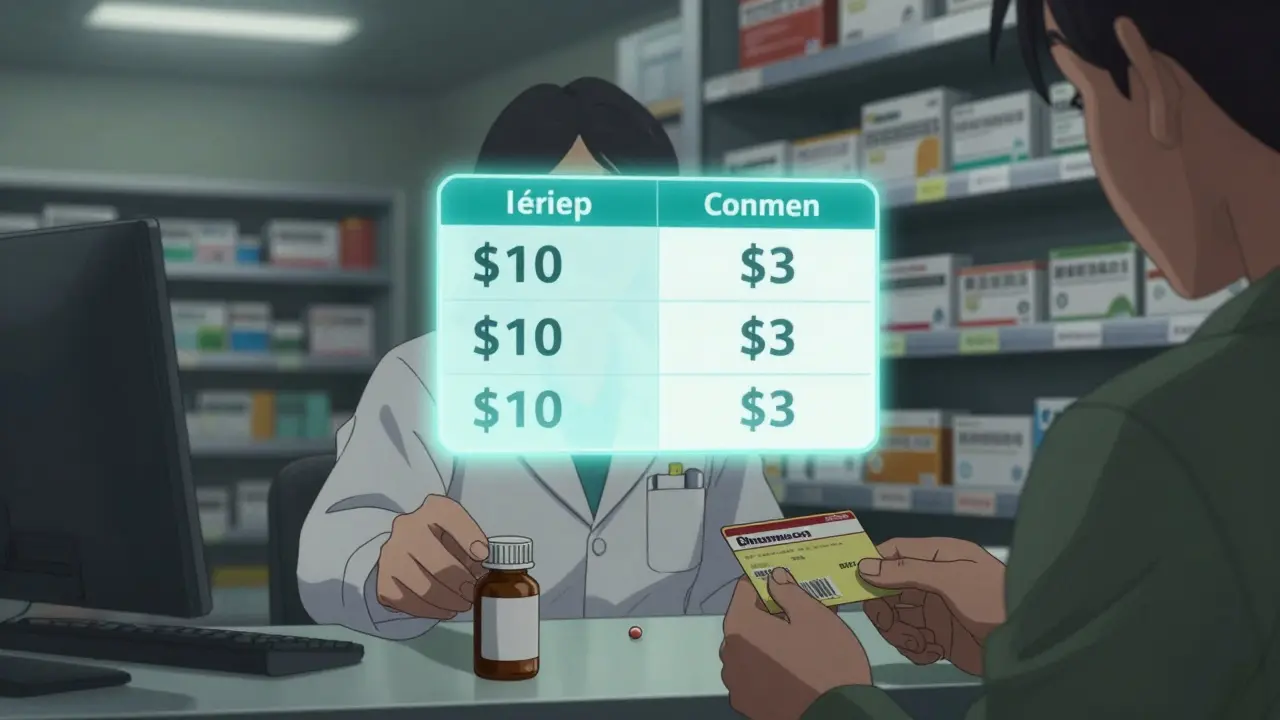

But if you’re on a typical insurance plan with a $10 copay for generics, the card won’t help. Often, your insurance price is lower. The Ohio State University College of Pharmacy found that for insured patients, discount cards rarely beat copays. They’re not for everyone. They’re for people who pay full price.

What You Can Save-And What You Can’t

Let’s be clear: these programs are built for generics. The savings on brand-name drugs? Minimal. A 2022 study showed that when brand-name drugs like SGLT2 inhibitors were added to a heart failure regimen, discount cards only cut costs by about 10%. That means a $1,500 monthly bill becomes $1,350. Still unaffordable for most.

Here’s what you can save on, reliably:

- Lisinopril (high blood pressure): $3-$6/month

- Metformin (diabetes): $4-$8/month

- Atorvastatin (cholesterol): $5-$10/month

- Levothyroxine (thyroid): $6-$12/month

- Simvastatin (cholesterol): $4-$9/month

These prices are common across GoodRx, SingleCare, and even Walmart’s $4 program. Many of these drugs have been on the market for decades. Their patents expired years ago. The cost to make them is pennies. The discount cards just help you pay what the drug actually costs-not what the system says it should.

How to Use Them Without Getting Lost

Using a discount card isn’t plug-and-play. It takes work. Here’s how to do it right:

- Find your drug’s name and dosage. Don’t rely on brand names. Use the generic.

- Go to GoodRx.com or download the app. Type in your medication.

- Check prices at 3-5 nearby pharmacies. Don’t stop at the first result.

- Compare those prices to your insurance copay. If your insurance is cheaper, skip the card.

- Print the coupon or pull it up on your phone. Bring it to the pharmacy.

- Ask the pharmacist to run it as cash, not insurance. They’ll know what to do.

It takes 5 to 15 minutes per prescription. For someone on five meds? That’s over an hour a month. But if you’re saving $80 on your cholesterol pill, it’s worth it.

The Hidden Problems

These programs aren’t perfect. Far from it.

First, prices change daily. One day, GoodRx gives you $4 for metformin. The next day, it’s $15. Why? Pharmacies adjust prices based on how many people use the card, how much they’re paying the provider, and even how busy they are. There’s no consistency.

Second, not all pharmacies participate. Some independent stores don’t accept discount cards at all. Others accept them but only if you pay in cash. If you try to use the card with insurance, it won’t work.

Third, there’s confusion. One Reddit user reported paying $15 for a drug with Blink Health, then $42 with GoodRx at the same pharmacy, same day. Another said they had to visit three different stores just to find the lowest price. That’s not just inconvenient-it delays care. And for people with chronic conditions, delays can mean hospital visits.

What the Experts Say

Dr. Wheeler, lead author of the 2022 study, calls discount cards a “partial solution.” They work great for generics. They’re useless for expensive brand-name drugs. And they shift the burden onto patients. Instead of fixing drug pricing, we’ve created a system where people have to become drug price detectives.

Pharmacists are catching on. Many now check discount card prices automatically before billing insurance. If your card saves you more than your copay, they’ll tell you. Ask them. Don’t assume your insurance is always the best deal.

And here’s a little-known fact: your belief in generics matters. A study from the NIH found that people who think generics are just as effective as brand-name drugs are three times more likely to use discount cards. That’s not just about money-it’s about trust. If you think generics are “cheap and weak,” you’ll pay more. And you don’t have to.

The Future of Discount Cards

Big pharmacy benefit managers (PBMs) like Express Scripts and OptumRx are starting to integrate discount card prices directly into their systems. That means, in the future, you might not have to check GoodRx at all. Your insurer might just show you the lowest price-insurance or discount card-automatically.

GoodRx is also adding telehealth services. You can now get a prescription through their app and have the discount applied before you even step into the pharmacy. That’s a step forward.

But without real control over brand-name drug prices, these programs will always be a band-aid. The cost of insulin, GLP-1 agonists, or newer diabetes drugs remains sky-high-even with discounts. The system isn’t broken because patients don’t know how to use cards. It’s broken because the prices are rigged.

Bottom Line: Use Them, But Know Their Limits

Coupon and discount card programs are powerful tools-if you’re paying full price. For generics, they can cut your bill by two-thirds. For brand-name drugs? Don’t expect miracles. Use them like a flashlight in the dark: they show you the cheapest path, but they don’t fix the road.

Start with the big ones: metformin, lisinopril, atorvastatin. Compare prices. Ask your pharmacist. Try GoodRx, NeedyMeds, and Walmart’s $4 list. If you save $50 a month, you’ve already earned back the time you spent.

And if you’re on insurance? Always check. Sometimes, your copay is higher than the cash price with a card. Don’t assume. Always ask.

Medication shouldn’t be a luxury. These cards won’t fix the system. But they can help you survive it.

Do discount cards work with insurance?

No. Discount cards are cash-only deals. You can’t use them with insurance at the same time. But you can compare the card price to your insurance copay and pick the cheaper option. Many pharmacies will check both for you-just ask.

Are discount cards free to use?

Yes. GoodRx, NeedyMeds, Blink Health, and others don’t charge you anything to use their cards. They make money from fees paid by pharmacies, not from patients. There are no subscriptions, no sign-ups, no hidden costs.

Can I use these cards for brand-name drugs?

You can, but don’t expect big savings. For brand-name drugs, discounts are usually under 10%. A drug that costs $1,500 a month might drop to $1,350-still far too expensive for most. These cards are designed for generics, not expensive specialty meds.

Why is the price different at every pharmacy?

Pharmacies set their own cash prices, and discount card providers negotiate different deals with each one. A big chain like CVS might offer a lower price to attract customers, while a small pharmacy might charge more because they don’t have the volume to negotiate lower rates. Always check multiple locations.

What if my pharmacy won’t honor the card?

Call ahead. Some pharmacies don’t participate in certain discount programs. If they refuse, ask for the cash price without the card-it might still be lower than your insurance copay. You can also try a different card or a different pharmacy. Walmart, Target, and Costco often have fixed low prices on common generics, no card needed.

Are these programs legal?

Yes. They’re legal and widely used. But there’s growing scrutiny from the Federal Trade Commission over how pharmacy benefit managers (PBMs) profit from these programs. Some models involve pharmacies paying fees to PBMs, who then share part of that with the discount provider. That’s under investigation, but using the card yourself is completely legal and safe.

Which discount card is the best?

There’s no single “best.” Prices vary by drug, pharmacy, and day. GoodRx has the widest reach (70,000+ pharmacies), but sometimes NeedyMeds or SingleCare offers a lower price. The only way to know is to check all of them. Use the apps. Compare. Save the lowest price for your next refill.

OMG I JUST SAVED $60 ON MY METFORMIN THIS MONTH!!! 🙌 GoodRx is my new best friend. I used to skip doses because I couldn’t afford it, now I’m taking it like a boss. Also, Walmart’s $4 list? LIFE CHANGER. 🏥💖