Getting a brand-name medication can feel like a financial shock. Some drugs cost over $2,000 a month. If you’re insured, you might think your plan will cover most of it-but that’s not always true. That’s where manufacturer copay assistance cards come in. These aren’t discounts you find online. They’re official programs from drug companies designed to lower your out-of-pocket cost-only if you have private insurance. But here’s the catch: if you don’t understand how they work, you could end up paying way more later.

What Exactly Is a Copay Assistance Card?

A manufacturer copay assistance card is a coupon issued directly by the company that makes your prescription drug. It doesn’t replace your insurance. Instead, it steps in to cover part or all of your copay or coinsurance when you fill your prescription at the pharmacy. For example, if your plan says you owe $500 for a monthly medication, the card might reduce that to $0. The drug company pays the rest directly to the pharmacy. These cards are almost always for expensive, brand-name drugs-especially ones without generic versions. Think biologics for rheumatoid arthritis, insulin for diabetes, or treatments for multiple sclerosis. These drugs can cost patients thousands per month. Without help, many people skip doses or stop taking them altogether. But here’s the rule you can’t ignore: you can’t use these cards if you’re on Medicare Part D, Medicaid, or if you have no insurance. Federal law blocks it. The cards are only for people with private, commercial health plans. If you’re on Medicare, you’ll need to look at other options like patient assistance programs or pharmacy discount cards.How Do You Get One?

Getting a card is simple-but you need to know where to look. Go to the website of the drug manufacturer. For example, if you’re taking Humira, visit AbbVie’s website. If it’s Enbrel, go to Amgen’s site. Most companies have a dedicated section called “Patient Assistance” or “Copay Support.” You’ll fill out a short form asking for your name, date of birth, insurance info, and your doctor’s details. You don’t need to submit medical records. The system checks if you qualify based on your insurance type and income. Most programs require you to earn under 500% of the federal poverty level, but many don’t even ask for income if you have private insurance. Once approved, you’ll get a digital card you can print or save on your phone. Some companies even mail you a physical card. You can also download the card through apps like GoodRx or RxSaver, but always confirm it’s the official manufacturer version-not a third-party discount.How to Use It at the Pharmacy

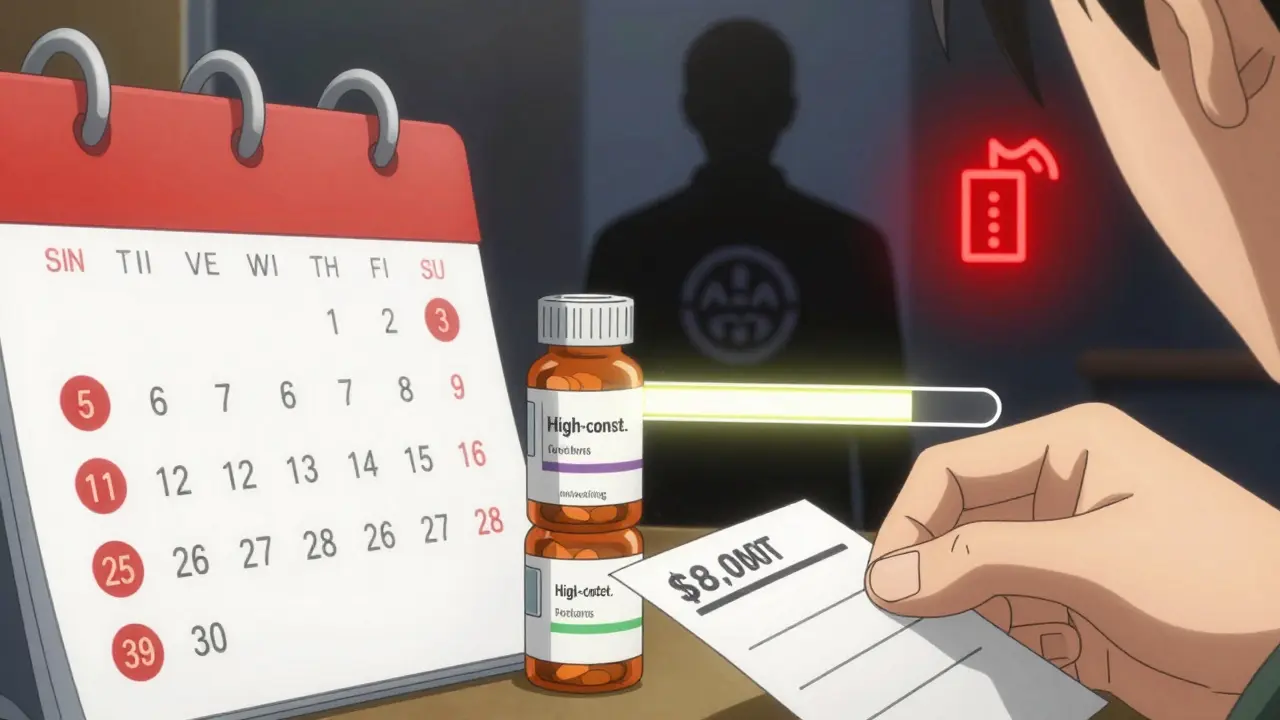

When you go to pick up your prescription, hand the card to the pharmacist along with your insurance card. The pharmacy’s system will scan both. The insurance pays its portion, then the copay card kicks in to cover the rest of what you owe. It’s automatic. You don’t need to do anything extra. The pharmacy handles the claim with the manufacturer’s system. You’ll see the reduced amount on your receipt. In many cases, you pay $0. But here’s where things get tricky. Not all cards are created equal. Most have an annual limit-often $8,000 per year. If your drug costs $2,000 a month, that card will cover you for exactly four months. After that, you’re on your own unless your plan has a special feature called a copay maximizer.

Copay Accumulator vs. Copay Maximizer: The Hidden Trap

This is the most important thing you need to know. Insurance companies don’t always let the manufacturer’s money count toward your deductible or out-of-pocket maximum. That’s because of something called a copay accumulator program. If your plan uses an accumulator, the $0 you paid thanks to the card doesn’t count as money you’ve spent toward your deductible. So even if you’ve used $8,000 in assistance, your deductible might still be $7,000. When the card runs out, you suddenly owe the full $2,000 next month-on top of your remaining deductible. A copay maximizer is slightly better. The insurer spreads the manufacturer’s contribution evenly across the year. So if you have $8,000 in assistance and a $10,000 deductible, the plan treats it like you’ve paid $8,000 toward your deductible, even if you paid $0 out of pocket. That means when the card ends, you’re already halfway there. The problem? About 70% of commercial insurance plans in the U.S. use accumulators, according to KFF. And most patients don’t find out until it’s too late.How to Find Out If Your Plan Uses an Accumulator

You can’t assume your plan is fair. You have to ask. Call the customer service number on your insurance card. Ask: “Does my plan use a copay accumulator or maximizer program for brand-name medications?” If they say “no,” great. Your card will help you reach your out-of-pocket maximum faster. If they say “yes,” or they don’t know, ask for the name of your pharmacy benefits manager (PBM)-that’s the company that handles your drug coverage. Then call the PBM directly. They’re required to disclose this info. If they refuse, file a complaint with your state’s insurance commissioner. Some states have passed laws to stop accumulators. California, Illinois, and New York now require manufacturers’ payments to count toward out-of-pocket limits. But many states still allow them. Don’t rely on your state to protect you-check yourself.What Happens When the Card Runs Out?

When your $8,000 runs out after four months, and your plan uses an accumulator, your next bill could be $2,000. That’s not a mistake. That’s how the system works. The best thing you can do is plan ahead. Track your monthly cost and your card’s annual limit. If you’re on a $2,000 drug with an $8,000 card, you have four months of coverage. Set a reminder for month three. A month before the card expires, contact the manufacturer’s patient support team. Ask if they offer any extended support, or if they can connect you to a nonprofit patient assistance program. Many drug companies have separate programs for people who can’t afford their meds after the card ends. These aren’t coupons-they’re free drug programs. You might qualify even if you have insurance, if your income is low enough.

This is one of those posts that should be printed and taped to every pharmacy counter. I’ve seen too many people get blindsided by copay accumulators-especially with insulin. You think you’re saving money, then boom, next month you’re choosing between rent and refills. The part about checking your PBM? That’s gold. Most folks don’t even know what a PBM is. Thanks for making this so clear.